Ohio Tax Rate 2025. There were no sales and use tax county rate changes effective april 1, 2025. With many americans still feeling squeezed by inflation, there's some good news now landing in their bank.

See how much Ohio's proposed tax cut would save you; details for, $25.74+.990% of excess over $5,200. This page has the latest ohio brackets and tax rates, plus a ohio income tax calculator.

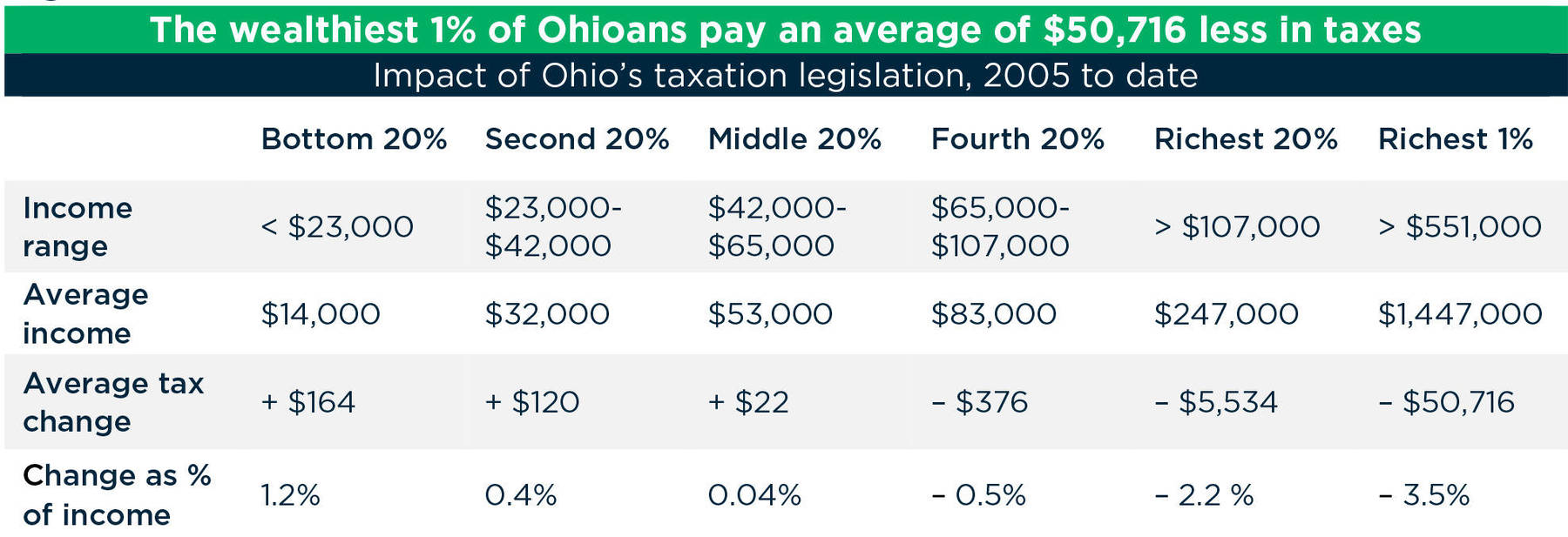

The great Ohio tax shift, 2025, Counties levy additional local taxes,. $25.74+.990% of excess over $5,200.

Tax rates for the 2025 year of assessment Just One Lap, Ohio law reduces personal income tax rates retroactive to january 1, 2025. North canton's income tax rate has been 1.5% since 1971.

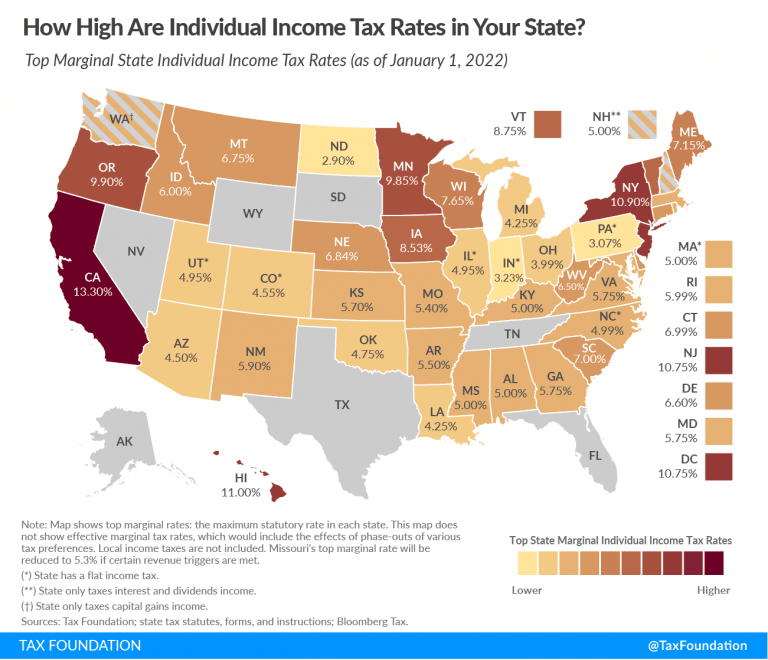

Ranking Of State Tax Rates INCOBEMAN, All rates are set to take effect on jan. Office of budget and management announces the preliminary february revenue data.

2025 state tax rate map Arnold Mote Wealth Management, To do that, look for “federal income tax. Six ohio municipalities are poised to increase local income tax rates in 2025.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, Discover the ohio tax tables for 2025, including tax rates and income thresholds. The new tax rate on income greater than $26,050 up to $100,000 is 2.75%;

Ohioans are spending more money on taxable things this year, including, Marginal tax rate 22% effective tax rate 10.94% federal income. Office of budget and management announces the preliminary february revenue data.

Where Ohio ranks for taxes, and other trends identified in new study, Discover the ohio tax tables for 2025, including tax rates and income thresholds. This page has the latest ohio brackets and tax rates, plus a ohio income tax calculator.

Ohio State Tax S 20202024 Form Fill Out and Sign Printable PDF, The new tax rate on income greater than $26,050 up to $100,000 is 2.75%; All other stark county cities have rates of 2% or 2.5% with varying credit for taxes paid to.

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, The new tax rate on income greater than $26,050 up to $100,000 is 2.75%; The president said billionaires pay an average federal tax rate of only 8.2%, but that’s a white house calculation that includes earnings on unsold stock.